China, with a weighting of over 30% of the MSCI Emerging Markets Index, fell more than 9% over the quarter, creating a significant hurdle for the entire emerging index to rise. China’s fall also masked a number of positives happening across other emerging markets, most notably Brazil, which rose over 20% and India which rose almost 13%.*

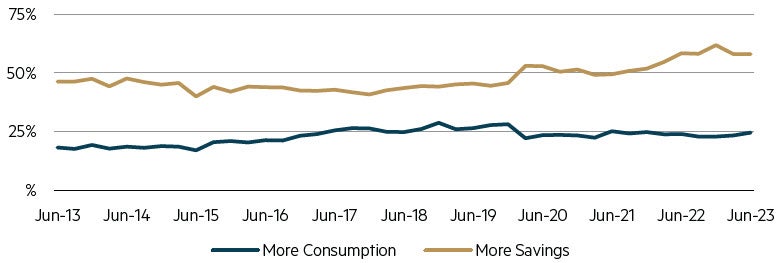

In our view, it is fair to say the reopening of China has disappointed. Years of lockdowns combined with a weak property market seem to have sapped consumer confidence. This is evidenced by weak loan growth numbers and an increasing trend for Chinese consumers to repay debt early, rather than spend their savings into the reopening. This is a continuation of the trend showing consumers continue to prefer to save rather than consume.

People’s Bank of China survey – consumers preferring to save over consume

Source: PBOC, Bloomberg, Maple-Brown Abbott, 6 July 2023.

In recent months members of our team made two trips to China. We found it will be some time before the self-employed recover their confidence. This requires an increasing overall spend on services, such as restaurants, which then employ more staff, which creates more income to spend on consumption – and so on. In the meantime, lead indicators for China’s manufacturing and exports, such as the PMI Manufacturing Index, have been running below 50 (indicating contraction) since the start of the second quarter. That said, the S&P Global PMI for Emerging Markets sits at 51.1, remaining in expansionary territory, while developed markets are currently at 46.3.

Doubt is not a pleasant position, but certainty is absurd – Voltaire

There is indeed doubt that exists over the Chinese economic recovery. In our opinion, therein lies the current opportunity for its equity market over the medium term. China is currently priced for a lot to go wrong, and not much to go right. The upcoming first half 2023 reporting season will be key – expectations are already low, but we will be monitoring for management teams to give any positive outlook in their commentary, or perhaps increase cash returns to shareholders. Contrast that negativity with India today, where the positive fundamentals of growth and reform are well known and – by our reckoning – rather at risk of not living up to lofty expectations. We continue to be patient holders of select Chinese equities as we wait for the reopening to progress.

Are emerging markets on a different cycle to developed markets?

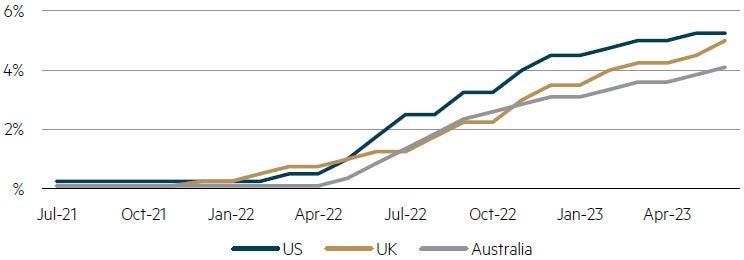

Having worked through the ’China can decouple’ investment thesis of 2008, we are sceptical of the concept that emerging markets can actually de-couple from developed markets and tread an idiosyncratic path. That said, there are objective differences in the economic cycles across emerging markets and developed markets today that give us reasons to consider that perhaps emerging markets will be the leaders of the next economic cycle.

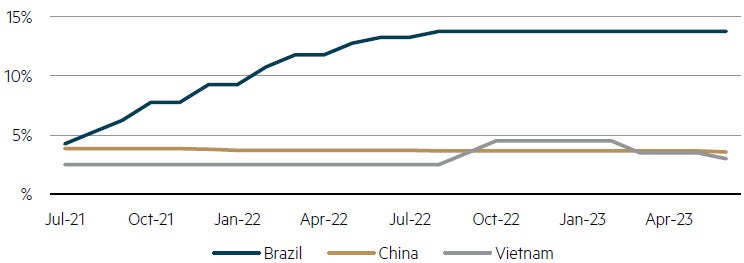

Brazil was the first country to raise interest rates in this cycle. Perhaps with emerging market central bankers being more recently conditioned to dealing with high rates of inflation, emerging markets have in general been ahead of developed markets in raising interest rates. Additionally, when it comes to fiscal spend, the Congressional Budget Office in the US forecasts a fiscal deficit in 2023 of over 5.0% of GDP,** surely adding fuel to the inflationary fire. In comparison, Brazil is targeting an equivalent deficit of 1.0%. Raising rates and controlling spending has led to a number of emerging markets bringing inflation back within their target ranges. Some countries including China and Vietnam are already moving to cut their central bank lending rates in order to stimulate growth. Correspondingly, Brazil is currently running at close to 10% real interest rates. While this has been negative for the Brazilian equity market and valuations, we believe this creates longer-term opportunities in Brazil and it is one area where we have recently been doing additional research to develop potential new portfolio inclusions.

Emerging market central banks moving early on rate rises

Select EM Central Bank Rates

Source: FactSet, Maple-Brown Abbott, 5 July 2023.

Select DM Central Bank Rates

Source: FactSet, Maple-Brown Abbott, 5 July 2023.

Parting thought

Emerging economies have generally been ahead of the curve in fighting inflation, without the need for additional fiscal spending. That leaves many emerging market governments and central banks well placed to stimulate for growth, should there be any economic slowdown. At the same time, many emerging market equity markets are still trading below long-run average valuations, as judged by price to book. In aggregate, this combination presents us, as active investors, with a myriad of longer term investment opportunities.

* Bloomberg, country returns within MSCI Emerging Markets Index, June 2023.

** Congressional Budget Office.

Disclaimer

This information was prepared and issued by Maple-Brown Abbott Ltd ABN 73 001 208 564, Australian Financial Service Licence No. 237296 (“MBA”). This information must not be reproduced or transmitted in any form without the prior written consent of MBA. This information does not constitute investment advice or an investment recommendation of any kind and should not be relied upon as such. This information is general information only and it does not have regard to any person’s investment objectives, financial situation or needs. Before making any investment decision, you should seek independent investment, legal, tax, accounting or other professional advice as appropriate, and obtain the relevant Product Disclosure Statement and Target Market Determination for any financial product you are considering. This information does not constitute an offer or solicitation by anyone in any jurisdiction. This information is not an advertisement and is not directed at any person in any jurisdiction where the publication or availability of the information is prohibited or restricted by law. Past performance is not a reliable indicator of future performance. Any comments about investments are not a recommendation to buy, sell or hold. Any views expressed on individual stocks or other investments, or any forecasts or estimates, are point in time views and may be based on certain assumptions and qualifications not set out in part or in full in this information. The views and opinions contained herein are those of the authors as at the date of publication and are subject to change due to market and other conditions. Such views and opinions may not necessarily represent those expressed or reflected in other MBA communications, strategies or funds. Information derived from sources is believed to be accurate, however such information has not been independently verified and may be subject to assumptions and qualifications compiled by the relevant source and this information does not purport to provide a complete description of all or any such assumptions and qualifications. To the extent permitted by law, neither MBA, nor any of its related parties, directors or employees, make any representation or warranty as to the accuracy, completeness, reasonableness or reliability of the information contained herein, or accept liability or responsibility for any losses, whether direct, indirect or consequential, relating to, or arising from, the use or reliance on any part of this information. Neither MBA, nor any of its related parties, directors or employees, make any representation or give any guarantee as to the return of capital, performance, any specific rate of return, or the taxation consequences of, any investment. This information is current at 5 July 2023 and is subject to change at any time without notice. You can access MBA’s Financial Services Guide here for further information about any financial services or products which MBA may provide. © 2023 Maple-Brown Abbott Limited.