By Phillip Hudak, CFA and Matt Griffin – Co-Portfolio Managers, Australian Small Companies

Viewpoint

- HSN is a profitable software company held in the Maple-Brown Abbott Australian Small Companies Fund (the Fund)

- We believe the stock is now in the ‘Improving Fundamentals’ segment of our investment process

- We see material earnings and share price upside if HSN can deliver on revenue targets driven by organic/inorganic growth expectations.

Hansen Technologies (HSN) is a global provider of operating software and services to the energy, water and communications industries. The company services more than 600 customers in over 80 countries providing software controlling critical revenue management and customer support processes, including customer care and billing lifecycle management, and metered management.*

HSN is a profitable and defensive technology stock which we believe is underappreciated by the market. We are attracted to the following characteristics:

- Provides mission-critical software to defensive industries, including energy and communications, and is leveraged to growing complexity in its end markets undergoing digital transformation.

- A recurring revenue base with high revenue visibility at the beginning of each year.

- Long track record of delivering modest organic growth combined with value accretive acquisitions.

- Founder-led business with significant management equity holding.

How we assess HSN using our process

Our investment philosophy is based on the core beliefs that: earnings drive share prices over the medium term; quality companies provide superior risk-reward characteristics and demonstrate strong, persistent earnings streams over the longer term; and companies that disappoint on short-term earnings expectations typically underperform.

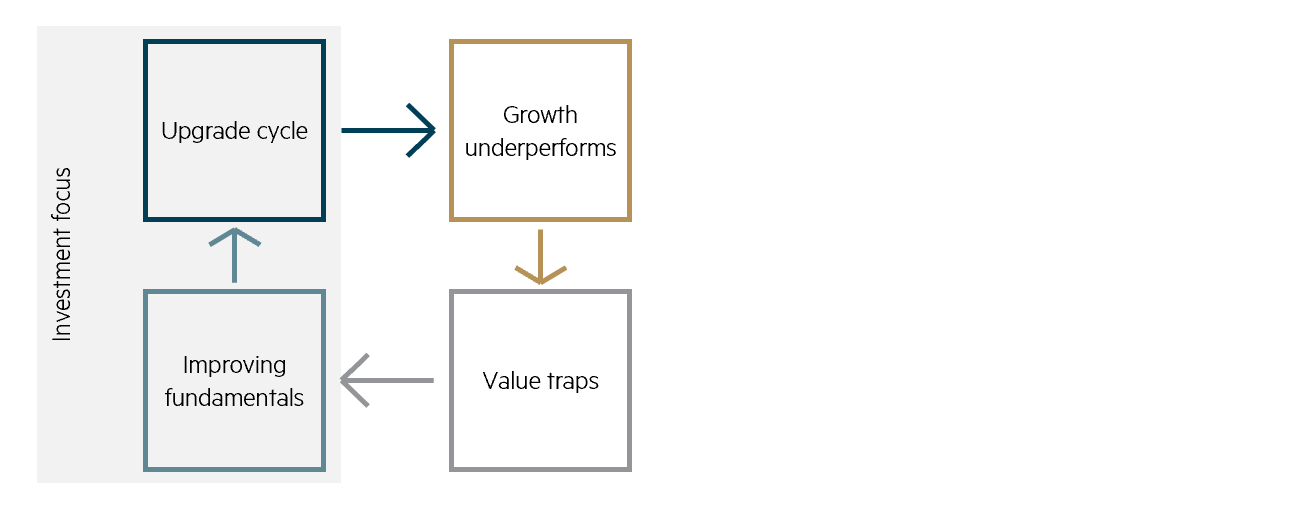

A key part of our stock assessment process is assessing where a company is in the ‘earnings lifecycle’.

Earnings lifecycle

In FY21, HSN’s earnings peaked partially due to the revenue recognition of a large contract award from Telefonica. The company subsequently entered the ‘Growth Underperforms’ segment of the earnings lifecycle in the back half of FY22 with underlying EBITDA margins mean-reverting back to historical averages (rebased from 36% in 1H21 to 31% in 2H23) given underinvestment in IT staff during COVID-19 which has subsequently caught up. The 1H23 result also disappointed market expectations given the lag in contract price increases with existing customers, underwhelming cash flow generation due to higher-than-expected capital expenditure and elevated receivables balance, short-term pullback in licence revenue and no acquisitions on the horizon. This resulted in the company transitioning into the ‘Value Trap’ segment of the earnings lifecycle.

We believe the stock is now in the ‘Improving Fundamentals’ segment with organic growth expected to be higher than the typical 3%-5% growth range in FY24 (and above consensus forecasts) given the catch-up in contract repricing coming through with existing customers, strong contract renewals, new logo/contract wins which have materially increased since FY21 and a rebound in licence revenue. In addition, we see margin expansion given CPI-linked price increases, lower staff churn and improving labour inflation which should drive improving profitability in FY24 and beyond. We also expect improved free cash flow generation as capital expenditure moderates to more normal levels and delayed receivables are collected in 2H23.

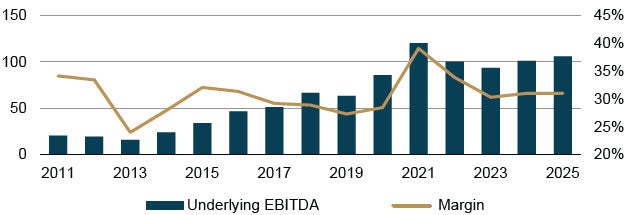

EBITDA ($m) and margin (%)

Source: Hansen Technology historical results, FactSet and MBA estimates, July 2023.

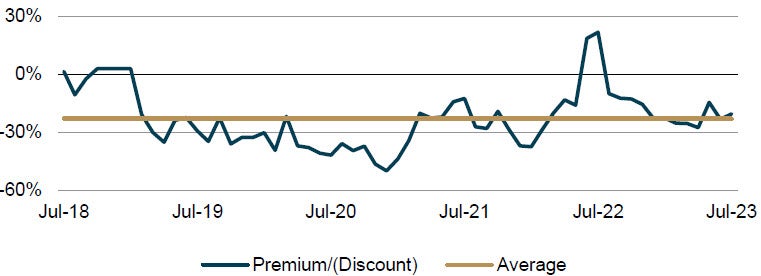

The balance sheet is expected to be in a net cash position by around July 2023 (update expected at the upcoming August 2023 reporting season) and the company has a highly disciplined approach to mergers and acquisitions with a track record of successful acquisitions. The company targets revenue of $500m in the medium term – this is likely to require a significant mergers and acquisitions component given the historically low organic growth of the underlying business (low single digits). If HSN achieves the targeted $500m revenue, we see material earnings and share price upside. Over the past six months, relative valuation has been more in line with long-term averages and given the strong earnings outlook, the Fund has materially increased its weight in the company.

P/E valuation multiple relative to peers

Source: FactSet and MBA estimates, peers include Data#3, Infomedia, ReadyTech and IRESS, July 2023.

Based on our investment process, HSN is assigned a ‘Strong Buy’ recommendation with an ‘Enabling’ Sustainability score and ‘Medium Risk’ risk score (due mainly to liquidity levels).

Parting thought

HSN’s inclusion in the Fund is a good example of our process in action, highlighting how ongoing, bottom-up company research using a proven, disciplined process and a focus on earnings can unearth valuable opportunities.

Disclaimer

This information was prepared and issued by Maple-Brown Abbott Ltd ABN 73 001 208 564, Australian Financial Service Licence No. 237296 (“MBA”). This information must not be reproduced or transmitted in any form without the prior written consent of MBA. This information does not constitute investment advice or an investment recommendation of any kind and should not be relied upon as such. This information is general information only and it does not have regard to any person’s investment objectives, financial situation or needs. Before making any investment decision, you should seek independent investment, legal, tax, accounting or other professional advice as appropriate, and obtain the relevant Product Disclosure Statement and Target Market Determination for any financial product you are considering. This information does not constitute an offer or solicitation by anyone in any jurisdiction. This information is not an advertisement and is not directed at any person in any jurisdiction where the publication or availability of the information is prohibited or restricted by law. Past performance is not a reliable indicator of future performance. Any comments about investments are not a recommendation to buy, sell or hold. Any views expressed on individual stocks or other investments, or any forecasts or estimates, are point in time views and may be based on certain assumptions and qualifications not set out in part or in full in this information. The views and opinions contained herein are those of the authors as at the date of publication and are subject to change due to market and other conditions. Such views and opinions may not necessarily represent those expressed or reflected in other MBA communications, strategies or funds. Information derived from sources is believed to be accurate, however such information has not been independently verified and may be subject to assumptions and qualifications compiled by the relevant source and this information does not purport to provide a complete description of all or any such assumptions and qualifications. To the extent permitted by law, neither MBA, nor any of its related parties, directors or employees, make any representation or warranty as to the accuracy, completeness, reasonableness or reliability of the information contained herein, or accept liability or responsibility for any losses, whether direct, indirect or consequential, relating to, or arising from, the use or reliance on any part of this information. Neither MBA, nor any of its related parties, directors or employees, make any representation or give any guarantee as to the return of capital, performance, any specific rate of return, or the taxation consequences of, any investment. This information is current at 21 July 2023 and is subject to change at any time without notice. You can access MBA’s Financial Services Guide here for further information about any financial services or products which MBA may provide. © 2023 Maple-Brown Abbott Limited.