Viewpoint

- South Korea – an opportunity hiding in plain sight

- Despite sound performance financial sector reflects ‘South Korea discount’

- Is it only a matter of time before more investors recognise the ‘many deeply undervalued companies’?

In our experience the best investment ideas are often found hiding in plain sight for all to see. After being among the worst performing equity markets in the world last year, there is mounting evidence that the South Korean market presents one such opportunity. Often a byword for ‘value trap’ with its illusively low headline multiples, the South Korean market has long confounded foreign and local investors alike. Many high-profile global investors including Elliott Management and Berkshire Hathaway have been drawn in by the allure of ostensibly world class companies trading at bargain basement prices reflecting what is often referred to as the ‘Korean discount’. With foreign ownership of Korean equities presently at multi-decade lows, such weak sentiment seems at odds with an economy the International Monetary Fund noted as having one of the most impressive recoveries globally from the COVID-19 pandemic.*

Here are some of the reasons we believe the long-standing South Korea discount will narrow soon.

Market reforms: Following the election last year of Yoon Suk-yeol, the conservative challenger who campaigned on a pro-growth agenda, both the finance minister and the country’s top financial regulator have also made supportive comments in recent months. Proposed market reforms are aimed at addressing the perennial Korean discount with the goal of attaining a reclassification by the major global index provider MSCI from its current emerging market status to the developed market index. Goldman Sachs have estimated that such a promotion would result in a $US56 billion uplift in incremental foreign portfolio flows from both passive and active investors.** As part of this process, constraints imposed on offshore trading in the Korean won, which is heavily regulated in terms of restricted trading hours and foreign participation, will be progressively removed over the next 12 to 18 months. In January of this year, the Financial Services Commission also announced a range of measures designed to encourage Korean-listed companies to better align their dividend policies and procedures with global best practices and to ensure a timely publication of English accounts.***

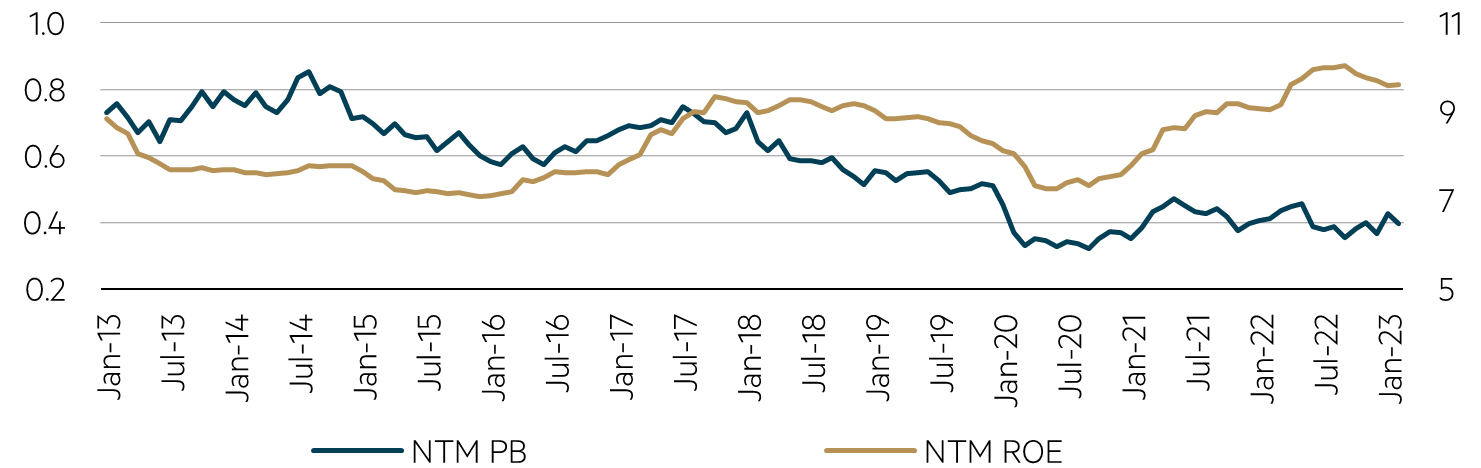

Financial stocks look attractively positioned: Nowhere is the South Korean discount more starkly reflected than in the financial sector, particularly among the banks. This is despite the sector delivering sound underlying performance throughout the challenging period of COVID dislocation.

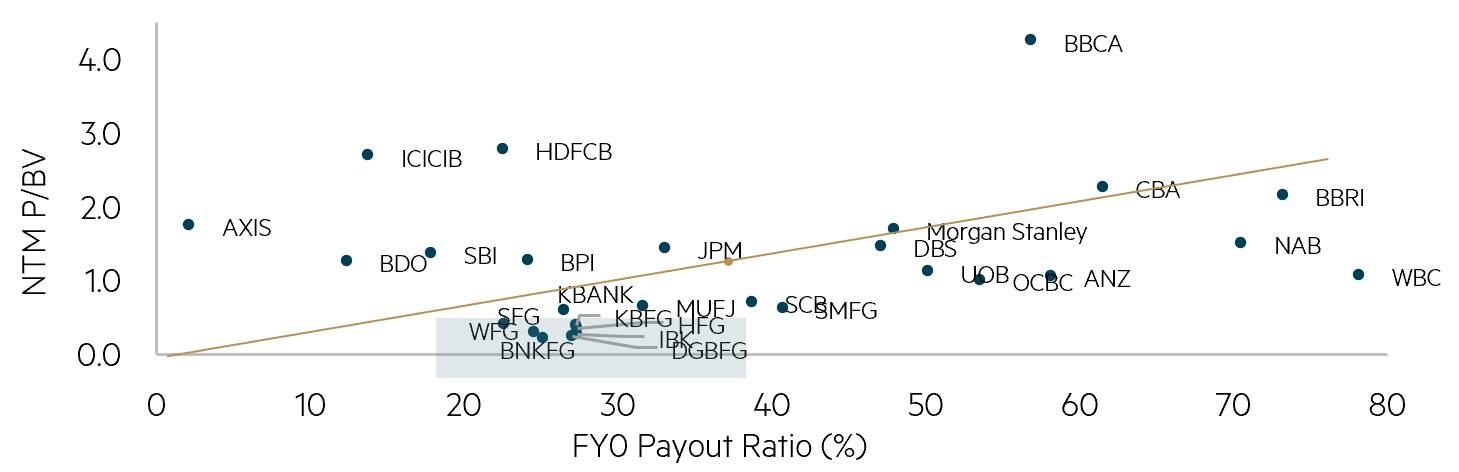

Shinhan Financial Group offers a strong example of this thematic and is an overweight holding across our Asian equity portfolios. In summary, its current valuations look incongruent with its recent history of improved profitability and its commitment towards growing total shareholder returns (TSR). At its recently announced FY22 results, the company reported a 15.7% increase in earnings per share over 2021 and has delivered a respectable five-year annualised growth rate of 6.7% per annum since the current management team was installed in 2017. Shinhan has also outlined a commitment to increase its TSR policy to between 30% and 40% of earnings from an historic average of 25.5%.^ While such a quantum may seem modest relative to other mature economies such as Australia or Singapore, a 40% TSR would equate to a not unattractive 7.4% yield on current FY23 estimates. As well as providing a valuable source of incremental return, the chart suggests a higher payout ratio may also precipitate a re-rating in the market multiple applied to the stock. With adequate capital buffers, conservative lending policies and a return on equity (ROE) above its cost of equity, the bottom-up investment case for Shinhan Financial Group appears strong.

Market is yet to reward improved shareholder returns

Shinhan Financial Group PB vs ROE over 10 years

Source: FactSet. Data as at 28 February 2023

Global banks - P/BV multiple vs. payout ratio

Source: FactSet. Data as at 28 February 2023

Parting thought

As any visitor to South Korea and particularly Seoul can attest, the country feels and looks far from ‘undeveloped’ in terms of its leading-edge technology and impressive infrastructure. Only time will tell if the developments outlined here are the portend of a fresh way of viewing the South Korean equity market. Meanwhile, we are encouraged by the positive inertia shown to date and expect this to be increasingly reflected in both the relative and absolute valuations ascribed to this very prospective market going forward. At current levels, we see many deeply undervalued companies across the South Korean market and have been adding exposure to our portfolios before too many others see the same opportunity.

Author

Geoff Bazzan

* IMF Country Report No. 22/86 March 2022

** The Korea Herald, Feb 14, 2023. Korea pins high hopes for MSCI upgrade

*** Financial Services Commission, Press Release Jan 31, 2023. Authorities Plan to Improve Rules Regarding Dividend in Line with Global Standards

^TSR includes cash dividend and share buybacks from 2017-2021

Disclaimer

This information was prepared and issued by Maple-Brown Abbott Ltd ABN 73 001 208 564, Australian Financial Service Licence No. 237296 (“MBA”). This information must not be reproduced or transmitted in any form without the prior written consent of MBA. This information does not constitute investment advice or an investment recommendation of any kind and should not be relied upon as such. This information is general information only and it does not have regard to any person’s investment objectives, financial situation or needs. Before making any investment decision, you should seek independent investment, legal, tax, accounting or other professional advice as appropriate. This information does not constitute an offer or solicitation by anyone in any jurisdiction. This information is not an advertisement and is not directed at any person in any jurisdiction where the publication or availability of the information is prohibited or restricted by law. Past performance is not a reliable indicator of future performance. Any comments about investments are not a recommendation to buy, sell or hold. Any views expressed on individual stocks or other investments, or any forecasts or estimates, are point in time views and may be based on certain assumptions and qualifications not set out in part or in full in this information. The views and opinions contained herein are those of the authors as at the date of publication and are subject to change due to market and other conditions. Such views and opinions may not necessarily represent those expressed or reflected in other MBA communications, strategies or funds. Information derived from sources is believed to be accurate, however such information has not been independently verified and may be subject to assumptions and qualifications compiled by the relevant source and this information does not purport to provide a complete description of all or any such assumptions and qualifications. To the extent permitted by law, neither MBA, nor any of its related parties, directors or employees, make any representation or warranty as to the accuracy, completeness, reasonableness or reliability of the information contained herein, or accept liability or responsibility for any losses, whether direct, indirect or consequential, relating to, or arising from, the use or reliance on any part of this information. Neither MBA, nor any of its related parties, directors or employees, make any representation or give any guarantee as to the return of capital, performance, any specific rate of return, or the taxation consequences of, any investment. This information is current at 24 February 2023 and is subject to change at any time without notice.

© 2023 Maple-Brown Abbott Limited