Viewpoint

- We believe the basket of worries faced by large domestic bank investors are already baked into share prices, with valuations currently reflecting more dire outcomes.

- In keeping with our bottom-up approach, our view on each of the ‘Big Four’ varies, however en masse earnings forecasts appear sensible and the sector should benefit from prolonged heightened interest rates.

- Current modest valuations and choppy markets see us ready to take advantage of any emerging pockets of longer-term value.

For the ‘Big Four’ heading into 2024, we expect low single-digit credit growth, ongoing net interest margin (NIM) compression, rising costs and a persistent increase in bad debts. So in aggregate, a basket of issues for investors to worry about. However, one must stay focused on the discount (or otherwise) to intrinsic value and make an assessment of share price reasonableness. Through this lens, we believe the bank sector currently looks quite reasonable.

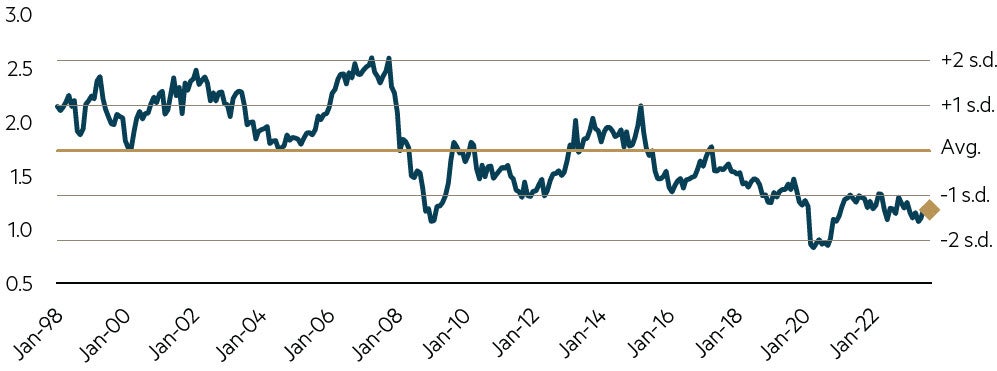

Source: IRESS, Goldman Sachs Global investment research, data to 30 September 2023. Past performance is not a reliable indicator of future performance.

The chart above highlights the price to book valuation metric of the banks, excluding Commonwealth Bank (the one bank which remains overpriced in our view). Collectively, the other banks are trading in line with where they bottomed out in the GFC and only modestly above where they bottomed out in the pandemic. While return on equity will be lower for the banks today than in prior years, largely due to increased capital requirements, it appears to us that bank share prices are already discounting tough conditions.

While plenty are anticipating a substantial economic slowdown, we believe the prognosis for the big Aussie banks isn’t as bad as many expect. This view is underpinned by our belief that Australia won’t experience a material recession in the short-medium term, plus each of the Big Four are well capitalized, strategically focused and battle-fit in their core markets.

Reporting season highlights – and lowlights

Following our analysis of the most recent set of half yearly financial results of the majors, the main call-outs from ‘bank reporting season’ were further NIM compression, relatively poor cost control and pristine credit.

While the headline / core NIM decline was 6–7 bps (for ANZ, NAB and WBC) what this obscured was the NIM movements in the different businesses. Essentially the Mortgage / Consumer businesses all got hammered while the Business / Institutional / NZ did much better (some NIMs even expanded). They all report differently but in the two ‘pure’ Mortgage / Retail books NIM fell ~24 bps for WBC and ~33 bps for ANZ (NAB write some mortgages in their business bank so it isn’t quite as ‘pure’). This level of NIM compression is unprecedented and thankfully (for the banks) there are signs this is moderating.

Cost control was largely disappointing and it isn’t fair to compare across banks as some (like ANZ and WBC) are still calling out ‘notable’ items, while NAB’s expense number is all in. In the current low growth high inflation environment, all the banks will need to do better on expenses and thus all have cost out / productivity programs to assist here.

Credit quality continues to be pristine with all (ex CBA who reported back in August) recently reporting credit charges substantially below ‘mid-cycle’ levels. While arrears have picked up, it is still off a very low base. Capital positions for the same three banks remains strong and above target levels. As such, both NAB and WBC have active buybacks with ANZ waiting until the final regulatory decision in relation to the Suncorp Bank acquisition before contemplating capital management. Suffice to say if the Suncorp transaction is knocked back, ANZ will have excess capital to pursue a substantial buyback.

Parting thoughts

The starting point for including select big domestic banks in our portfolios is that the sector benefits from higher interest rates. This, married with ‘sensible’ earnings forecasts and modest valuations (ex CBA), leaves us positively disposed to the sector.

The Maple-Brown Abbott Australian Share Fund is currently positioned with overweight allocations to ANZ, WBC and NAB and does not hold CBA.

The expected future revenue and cost profile for all the major banks produces a relatively flat earnings outlook. However, we forecast most banks can still generate a satisfactory total return to investors, largely driven by high single-digit gross dividend yields (including franking). Further upside exists if credit charges prove too pessimistic (which has been the case so far) and modest capital management opportunities are exercised.

As value managers and bottom-up stock pickers we continue to watch the bank sector closely for emerging pockets of longer-term value.

Disclaimer

This information was prepared and issued by Maple-Brown Abbott Ltd ABN 73 001 208 564, Australian Financial Service Licence No. 237296 (“MBA”). This information must not be reproduced or transmitted in any form without the prior written consent of MBA. This information does not constitute investment advice or an investment recommendation of any kind and should not be relied upon as such. This information is general information only and it does not have regard to any person’s investment objectives, financial situation or needs. Before making any investment decision, you should seek independent investment, legal, tax, accounting or other professional advice as appropriate, and obtain the relevant Product Disclosure Statement and Target Market Determination for any financial product you are considering. This information does not constitute an offer or solicitation by anyone in any jurisdiction. This information is not an advertisement and is not directed at any person in any jurisdiction where the publication or availability of the information is prohibited or restricted by law. Past performance is not a reliable indicator of future performance. Any comments about investments are not a recommendation to buy, sell or hold. Any views expressed on individual stocks or other investments, or any forecasts or estimates, are point in time views and may be based on certain assumptions and qualifications not set out in part or in full in this information. The views and opinions contained herein are those of the authors as at the date of publication and are subject to change due to market and other conditions. Such views and opinions may not necessarily represent those expressed or reflected in other MBA communications, strategies or funds. Information derived from sources is believed to be accurate, however such information has not been independently verified and may be subject to assumptions and qualifications compiled by the relevant source and this information does not purport to provide a complete description of all or any such assumptions and qualifications. To the extent permitted by law, neither MBA, nor any of its related parties, directors or employees, make any representation or warranty as to the accuracy, completeness, reasonableness or reliability of the information contained herein, or accept liability or responsibility for any losses, whether direct, indirect or consequential, relating to, or arising from, the use or reliance on any part of this information. Neither MBA, nor any of its related parties, directors or employees, make any representation or give any guarantee as to the return of capital, performance, any specific rate of return, or the taxation consequences of, any investment. This information is current at 28 November 2023 and is subject to change at any time without notice. You can access MBA’s Financial Services Guide here for further information about any financial services or products which MBA may provide. © 2023 Maple-Brown Abbott Limited.